A decade of lessons in margins, stockouts, and top-tier talent

Spring 2015: I was a 35-year-old founder riding 30% YoY growth and convinced momentum would carry us forever. Then 2018 hit—tariffs spiked our aluminum costs by 25% and crushed margins. Two years later, COVID erased half our POs in a month.

Those shocks cemented three truths: robust margins, balanced inventory, and elite in-house talent are non-negotiable. Since then I’ve coached CEOs through the same storms. Here’s the distilled playbook you can use now.

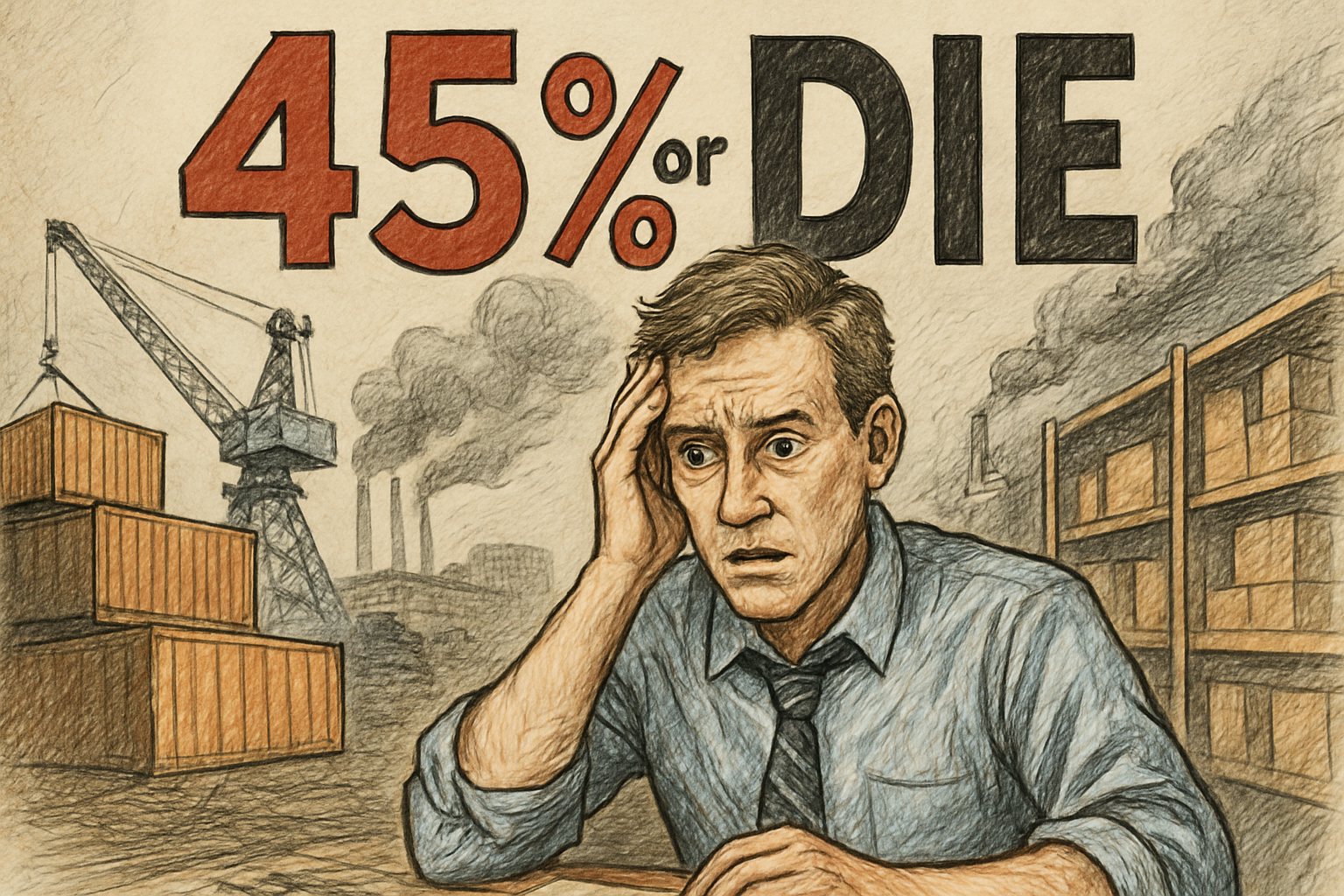

Lesson 1: Margin Matters More Than Ever — Protect Your 45%

With China tariffs hardening around ~50%, every point of gross margin counts. Under 45% is precarious.

Before vs. After (illustrative):

-

45% pre-tariff → 33% after tariff (danger) → 45% after renegotiation + pricing (safe)

-

38% pre-tariff → 25% after tariff (critical) → ~37% after actions (still risky)

Real-world moves we’re seeing:

-

Companies pushing single-digit price increases and holding demand

-

Cost downs via alt geography (e.g., Vietnam) and materials

CEO Margin Action Plan (start this week):

-

Source 3+ alternative factories; target 15% reduction, accept no lower than 8%.

-

Lift prices 2–4% quarterly until post-tariff margins stabilize >40%.

-

Explore First-Sale valuation, light assembly in Mexico, or HTS optimization on top SKUs.

Lesson 2: Why Inventory Turns Above 4× Court Disaster

If you’re turning inventory >4× annually, one 90–120 day delay from Asia can wipe out months of sales.

Risk profile by turns (summary):

-

2.5×: Stockout risk low, WC high, margin impact low

-

3.5×: Risk moderate, WC moderate, margin hit moderate

-

4.5×: Risk high (≈29%), margin hit –2 pts from rush fees

-

5.5×: Risk 40%+, margin hit –4 pts and chargebacks

Inventory Protection Moves:

-

Cap turns at 3.8× until supply reliably delivers ≤45 days.

-

Hold 30-day emergency stock of top SKUs at a domestic 3PL.

-

Re-tune order cadence each quarter—avoid shrinking your buffer to “optimize” cash only to eat airfreight later.

Lesson 3: Keep Brains, Outsource Hands

Outsourcing looks cheaper—until it kneecaps growth and margin resilience. Elite in-house leaders correlate with 2.4× revenue growth and +5 gross-margin points.

Keep in-house: Brand & creative strategy, growth/e-commerce, ops & analytics.

Outsource/automate: Media buying, customer service, bookkeeping.

Talent Roadmap:

-

Budget cash or equity to land A-players in growth and ops.

-

Push transactional work out; keep strategic roles internal.

-

Quarterly people audit—mediocre hires erode profit faster than tariffs.

Your Integrated 90-Day Action Blueprint

Days 0–30

-

Margin: Negotiate –10% FOB on key SKUs

-

Inventory: Map & cap turns at 3.8×

-

Talent: Define benchmarks for a top growth leader

Days 31–60

-

Margin: +4% price on targeted SKUs

-

Inventory: Build 30-day buffer for top movers at a US 3PL

-

Talent: Post VP roles with clear scorecards + equity

Days 61–90

-

Margin: Evaluate Mexico light-assembly options

-

Inventory: Dual-source your highest-volume SKU

-

Talent: Finalize org, outsource routine tasks, keep brains inside

Closing Thoughts: Choose Your Numbers Wisely

I once believed growth solved everything. Tariffs and COVID taught me otherwise. The 2025 playbook rests on three truths:

-

45% margin is oxygen—protect it.

-

Turns above 4× amplify risk—balance wisely.

-

Cut costs with intent—never at the expense of elite talent.

Leaders who respect these numbers won’t just survive 2025—they’ll build eight-figure valuations and real exit options.

Take the Next Step

Want a fast, pragmatic read on your exposure?

I run a 14-Day Apex CEO Exit-Readiness Audit focused on margin, inventory, and talent—with a step-by-step, do-this-next plan.

DM me “Audit” on LinkedIn or email luke@apexceo.co to safeguard and scale your valuation now.