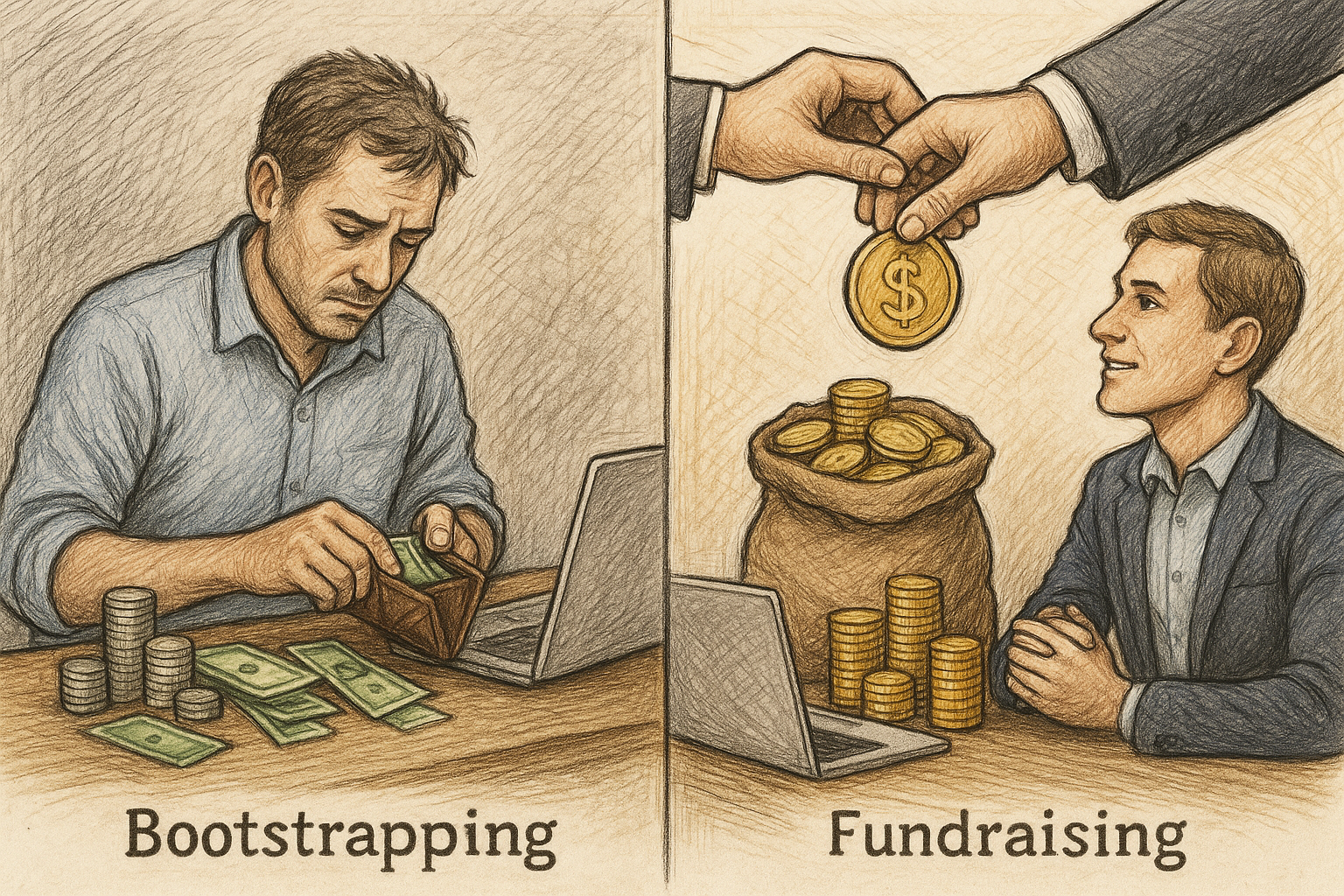

One of the earliest and most critical decisions a founder faces is whether to bootstrap or raise outside capital. That single choice sets the tone for how you scale, how fast you move, and how much control you keep.

Founders often reach out to me for advice—or sometimes capital—and my first question is always:

“Why don’t you bootstrap?”

The truth is, there isn’t a universal answer. Both approaches have real advantages and challenges. The key is knowing which path fits your market, your goals, and your tolerance for risk.

1. Is Your Market Big Enough to Justify Fundraising?

Venture capital is built on exponential returns. If your total addressable market (TAM) can’t realistically hit $100M+ in the next 3–5 years, VCs probably won’t be interested.

Fact to note: Fewer than 1% of U.S. companies ever reach $100M in revenue.

If your market is niche or you’re building a steady, sustainable company, bootstrapping is often smarter—you keep control and avoid chasing unrealistic investor-driven growth.

2. Know Your Industry’s Capital Needs

Some industries require huge upfront investment—pharma, hardware, deep tech. Without outside capital, it’s nearly impossible to survive.

Others, like services, retail, or digital products, can be launched lean. Bootstrapping here makes sense—you can validate ideas without giving up equity.

Take consumer goods: tooling and supply chains used to cost millions. Today, global manufacturing has lowered those barriers. The trade-off? Competition is fierce.

3. Match Your Funding Strategy to Growth Goals

VC funding means speed—milestones, aggressive expansion, and a clear exit path. Bootstrapping means pacing yourself, accountable only to your own strategy.

Credibility matters too. A first-time founder has a tougher time raising capital than someone with a past exit.

4. Be Honest About Risk Tolerance

Bootstrapping often means putting your own savings on the line, working side hustles, or starting small to prove your model.

Fundraising reduces personal financial exposure but comes with strings: equity dilution, a board, and investor pressure.

5. Have You Nailed Product-Market Fit?

Investors don’t fund experiments—they fund proven demand.

Ask yourself:

-

Are customers already buying?

-

Do you see repeatable demand?

If not, bootstrapping gives you space to refine without outside pressure. If yes, capital can accelerate scale.

6. Does Your Team Have the Experience to Go Solo?

A seasoned team with industry know-how can bootstrap more effectively. Networks and experience reduce reliance on outside support.

If your team is green or missing critical skills, investors can bring more than cash—they can open doors, mentor, and guide strategy.

7. Control vs. Collaboration—Know Yourself

Some founders thrive on independence and resist investor oversight. Bootstrapping lets you steer alone.

Others want accountability, guidance, and external partners pushing growth. Fundraising brings that—but also new voices at the table.

The Case for Each Path

Bootstrapping:

-

Full control

-

No equity dilution

-

Long-term, steady growth

Fundraising:

-

Capital for rapid scale

-

Strategic partners and networks

-

Lower personal financial risk

Action Step

Before deciding, ask yourself:

-

What are my growth goals—steady or exponential?

-

What’s my personal risk tolerance?

-

Does my market demand heavy upfront capital?

Still uncertain? I’m offering a free 20-minute strategy session to help you weigh your options. Together we’ll cut through the noise and build a plan that fits your goals.

The right funding choice can transform your business—let’s make sure you choose the one that serves you best.