When I started my company in a garage, we had multiple offers to raise capital. Good offers. Tempting offers.

But we said no — every time.

That discipline gave me what most founders never get:

-

100% control

-

100% ownership

-

No dilution

-

No down rounds

-

No board forcing a pivot into the latest trend

When we sold to private equity in 2021, we kept all the upside.

No cleanup. No cap table gymnastics. No “sorry, your stake isn’t worth what it used to be.”

That is the founder advantage — if you protect it.

What Founders Can Learn from the AI Bifurcation

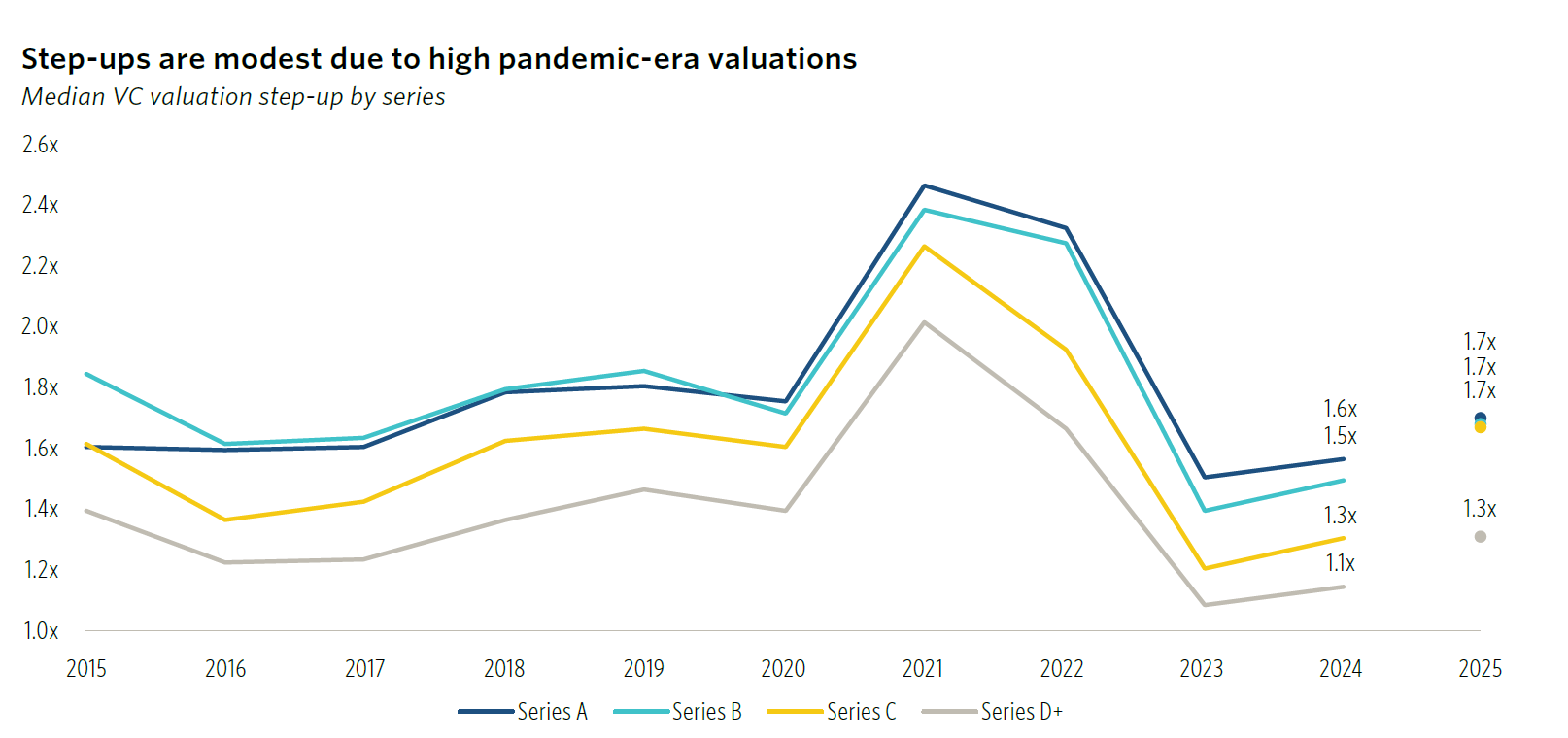

PitchBook’s Q2 2025 report says it all:

-

AI companies = 65% of investment capital, but only 35% of deals

-

AI valuations = 56% higher at Series C, 230% higher at Series D+

-

Down rounds = 15.9% of all deals

Translation:

A tiny concentration of companies are overvalued, while the rest of the market is in a valuation reset.

If you're a founder doing $5M–$50M in revenue, here’s what this means:

Don’t build your business around hype cycles.

Build it around margin, discipline, and control.

You will never compete with VC dollars — and you don’t need to.

You have something better: execution.

**Apply the Apex CEO Playbook (APPM)

This Is How You Win Without VC Money**

Every founder I coach learns the same truth:

You don’t need venture capital.

You need discipline in four areas.

1. Alignment

If your leaders aren’t aligned on the real goal, you’re dead before you start.

Ask yourself:

-

Does my team know the company’s top 3 quarterly goals?

-

Do they own KPIs?

-

Do I hold them accountable weekly?

Misalignment kills founder-led companies faster than competition.

VC-backed startups call this a “valuation haircut.”

Founders call it chaos.

Keep the team focused on your moat — not whatever is trending.

2. Product

If you can’t win at product, you don’t have a future and you don’t have an exit.

Do you have:

-

A real comparison against your top five competitors?

-

A clear product advantage?

-

Proof you’re not competing on price?

If you can’t articulate why you win, buyers can’t either.

3. People

You’re not stuck — you’re just keeping the wrong people.

Founders often tell me they’re overwhelmed.

When I look deeper, I usually find:

-

No formal meeting rhythm

-

No accountability

-

Too many B-players kept out of comfort

-

A CEO who is too soft

-

Leaders who aren’t actually leading

Fix this, and your business doubles in speed — without adding headcount.

4. Margins

If you’re not top 25% EBITDA in your sector, you will not sell on your terms. Period.

Do you know what top 25% is in your industry?

Most CEOs don’t.

Margins show discipline.

Margins show control.

Margins determine valuation.

VC-funded companies can survive without them.

Founder-led companies cannot.

Leadership Discipline Is the Founder’s Moat

Here’s how I built my company — and how I coach CEOs today:

✔ Stay focused on profitable growth

Top-line doesn’t matter if EBITDA vanishes.

✔ Build your leadership bench

Every hire — if you can afford it — should be leadership-caliber.

✔ Drive alignment and accountability

PE buyers don’t pay premiums for chaos.

They pay for companies with rhythm and structure.

✔ Execute relentlessly

A plan no one follows is just a Word doc.

✔ Prepare early

IPO-ready and exit-ready companies start the work years before bankers show up.

The Takeaway: Hype Raises Capital. Execution Creates Exits.

The VC market will always rotate to the next shiny thing.

Yesterday it was crypto.

Today it’s AI.

Tomorrow it will be something else.

But none of that changes the laws that govern real founder-led companies:

-

Hype raises capital.

-

Execution creates exits.

-

Valuations come and go.

-

Margins endure.

-

Control is earned.

-

Discipline is the multiplier.

Founders who stay focused on Alignment, Product, People, and Margins aren’t just building resilient companies — they’re building companies buyers fight to own.

And they do it without giving away their equity, their board seat, or their control.

If you want help building the discipline, structure, and strategy that make your company exit-ready — not hype-ready — send me a message or book a call.

I’ll show you exactly where the gaps are and how to close them.