Why Founder-CEOs Must Adapt Now or Risk Missing Their Window

I. What Just Changed—and Why It Matters

In 2021, I sold my company to private equity. We had strong EBITDA, clean financials, and a growing brand. The timing was ideal:

✔️ Low interest rates

✔️ Aggressive buyers

✔️ Multiple offers on the table

Today? That environment is gone.

Last week, reciprocal tariffs were announced on dozens of countries. The impact was immediate—especially in the private equity world. Not because PE firms can’t adapt, but because tariffs inject new uncertainty into an already cautious market.

If you're a founder-CEO planning to exit in the next 12–24 months, this matters.

II. The Chain Reaction: From Tariffs to Tougher Exits

Here’s what’s happening behind the scenes:

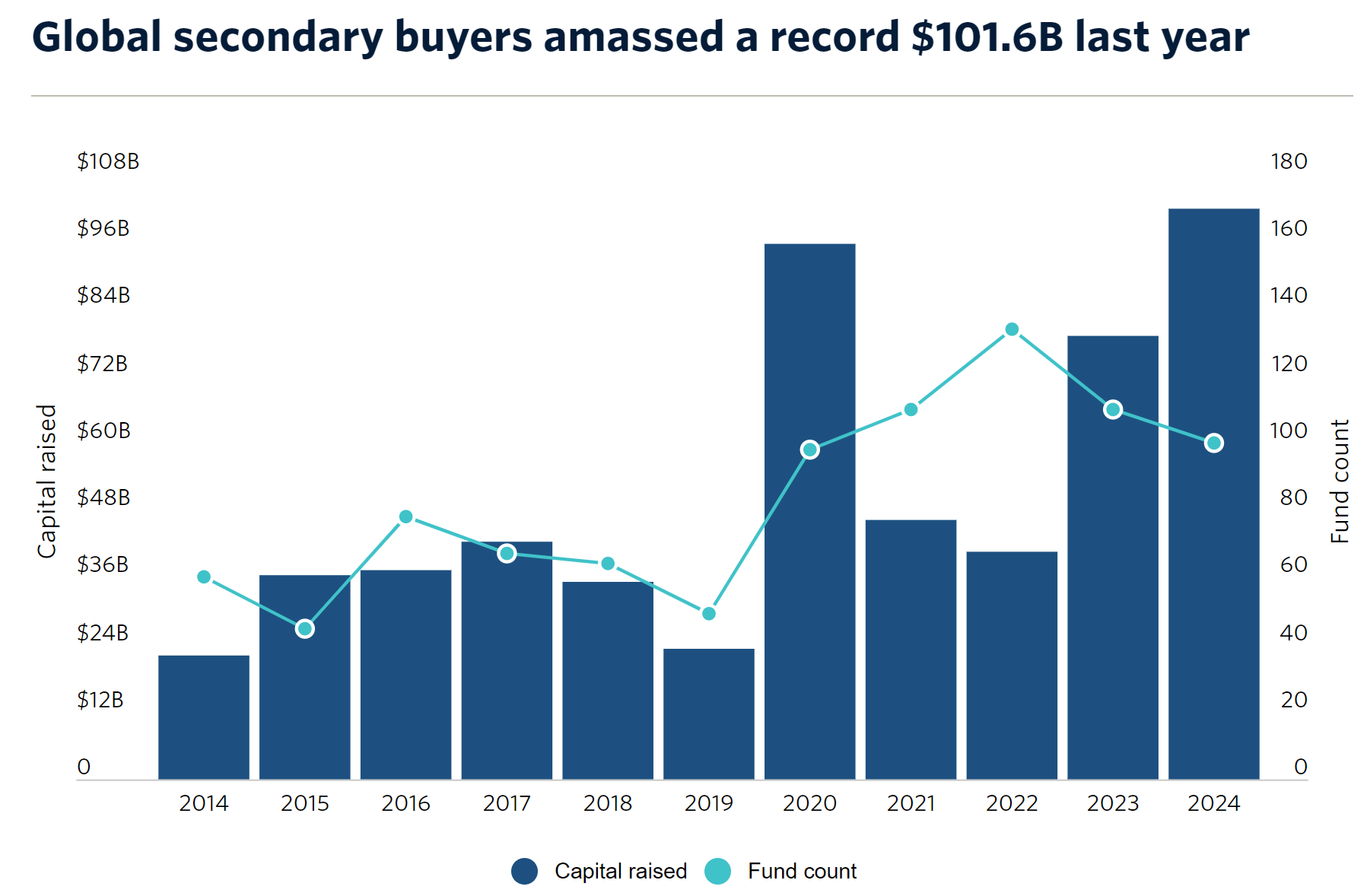

🔺 Secondary markets froze — LPs (the investors behind PE funds) paused, asking whether their capital was at risk.

📉 Deal flow slowed — PE firms began pulling back on acquisitions, especially in sectors exposed to international sourcing.

🧾 Valuations dipped — Supply-chain risk now triggers deeper diligence and lower multiples.

⏳ Deals drag — Bid-ask spreads widen, timelines stretch, and earnouts become more common.

Even companies not directly importing from tariffed countries are seeing buyers hesitate.

III. If You're a Founder CEO, Here's What It Means

These shifts trickle down fast. You might not feel them today—but you will when you go to sell.

Here’s what to expect:

-

Fewer buyers in-market – Especially for product-based businesses or importers.

-

Lower valuations – Margins under pressure = lower offers.

-

Tighter diligence – Buyers will scrutinize supply chain exposure, unit economics, and sourcing durability.

-

Longer exit timelines – Expect a slower close and more legal protections (e.g., pricing adjustments, contingencies).

-

Higher narrative stakes – You need a compelling story that offsets market risk.

IV. The Broader Impact: PE Slowdowns Hurt Small Business Sellers

Private equity isn’t just about billion-dollar deals. Most of my clients are in the $2M–$20M EBITDA range—the lower middle market. That’s where PE pullback hits the hardest.

If you run a consumer product, hardware, or supply-driven company and rely on imports, you may now be labeled “high-risk” by buyers—even if nothing’s changed on your end.

As one investor recently told PitchBook, buying a supply-chain-reliant company right now feels like “catching a falling knife.”

That mindset can kill your deal before it starts.

V. What to Do Now: 5 Moves for Founders Planning a Sale

If you’re targeting an exit in the next 12 to 24 months, now’s the time to act—not wait.

If you’re targeting an exit in the next 12 to 24 months, now’s the time to act—not wait.

Here’s your short-term playbook:

-

Tighten Your Financials

→ Get a current QofE. Clean, accurate numbers accelerate trust and speed up diligence. -

Know Your Supply Chain Risk

→ Map every vendor. Be ready with contingency plans and risk mitigation strategies. -

Strengthen Your Growth Narrative

→ Show how you’ll grow in spite of tariffs—not just survive. -

Expand Your Buyer List

→ Don’t bank on one offer. You need multiple conversations in motion. -

Work With a PE-Savvy Advisor

→ Exit positioning is now more critical than ever. You can’t wing it in this market.

VI. This Isn’t Permanent—But It’s Real

Tariffs won’t last forever. Neither will this investor freeze.

Historically, periods of caution create pent-up demand. When the fog lifts—whether through rate cuts, tariff adjustments, or economic clarity—the buyers will come back fast.

And when they do, the most prepared founders will win.

So yes, conditions just got tougher. But with the right playbook, this could still be your window. I’ve been through it—and I help other CEOs navigate it every day.

📩 Let’s talk if you’re unsure how these changes affect your exit.

luke@apexceo.co